Wisconsin Lottery and Gaming Credit

WISCONSIN LOTTERY AND GAMING CREDIT

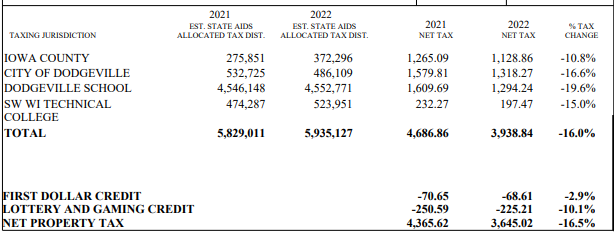

The Lottery and Gaming Credit is a credit displayed on Property Tax Bill for Real Estate as a reduction of property taxes for Wisconsin property owners using the property as their Primary Residence.

To qualify for the Lottery and Gaming Credit, you must:

- Be a Wisconsin resident,

- Own a dwelling, and

- Use the dwelling as your Primary Residence as of January 1 certification date of the year the property taxes are levied.

If an owner is temporarily absent, typically for a period no longer than six (6) months (ex: hospital, vacation, incarcerated), the Primary Residence is the home where the owner returns. Principal dwelling means any dwelling the owner of the dwelling uses as his/her primary residence.

A property owner may claim only one Primary Residence. You cannot claim the Lottery and Gaming Credit on:

- Business property,

- Rental units,

- Vacant land,

- Garages, or

- Property that is not the owners Primary Residence.

To receive the credit for 2023 and future years, fill out the 2023 Credit Application. Between January 1 and January 31, 2023, return the application to your local municipal treasurer. After January 31, 2023, return the application to the Iowa County Treasurer before November 1, 2023.

After January 31, 20239, if you did not receive the credit for 2022 taxes (payable in 2023) and think you are eligible, you can still claim the credit from the Department of Revenue (DOR) until October 1, 2023. Fill out the 2022 LATE Credit Application and send it to the Department of Revenue along with a copy of your 2022 tax bill.

Any questions, call the Iowa County Treasurer, 608-935-0397

Lottery Credit Forms

2023 Lottery and Gaming Credit Application

2022 LATE Lottery and Gaming Credit Application

2022 REMOVAL Lottery and Gaming Credit Application